Blockchain Remittance: The Future of International Money

Blockchain remittance firms are experiencing record growth thanks to an increase in global migration. As populations continue to migrate, the need to send money back to their home countries is growing. Blockchain remittance firms are providing this essential service at a reduced rate.

These international payments are vital to the livelihood of millions of people around the world. They’re primarily used for living expenses such as food, transportation, and education. Making these statements more tangible, East Asian countries received $129 billion in remittance payments last year according to the World Bank.

Remittance Stats

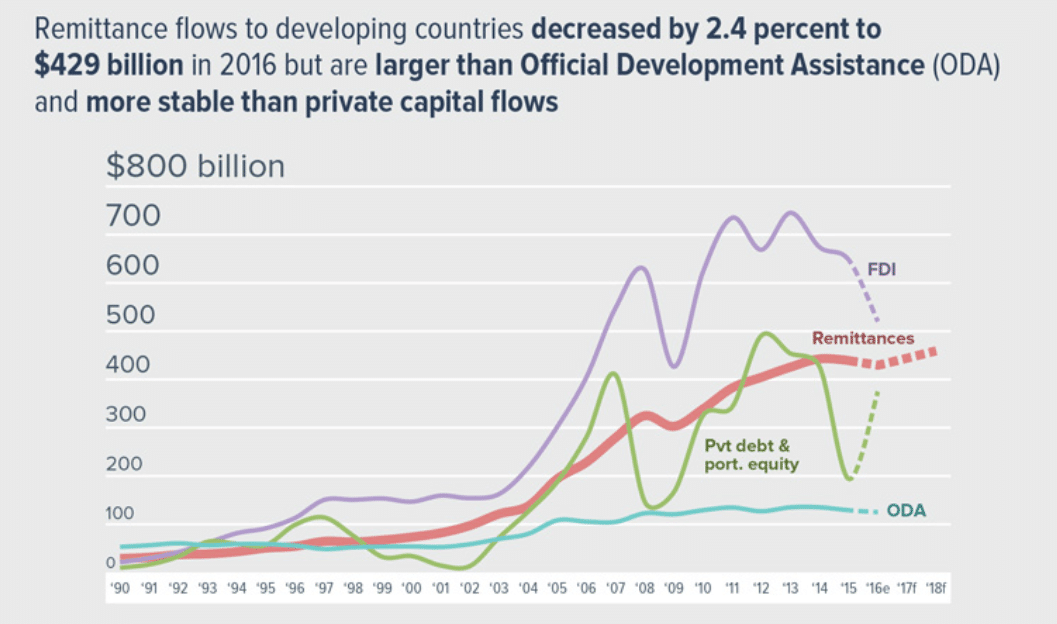

A recent study revealed that the remittance sector has grown to a staggering $585 billion industry. In 2017 alone, $439 billion was sent to developing countries, equating to around 700 million families living off of remittance payments globally.

Remittance payments have also become the main source of foreign income for many nations. According to a May report in Forbes, Mexico’s remittance payments have now superseded their oil industry to become the country’s main source of foreign income.

Mexico isn’t alone in their dependence on remittance payments. The World Bank released their 2016 remittance statistics in April of this year. The report revealed that remittance payments are now more stable than private capital flow in terms of international growth. This means that the remittance industry could be a smart investment in most parts of the world.

The High Costs of Sending Remittance Payments

Sending money internationally isn’t cheap, and non-profits such as the World Bank have been combating these high fees for years. Since 2008, remittance fees have declined 7.32 percent. This decrease saved migrants $90 billion in fees over the same time frame.

Whenever someone sends money internationally, numerous third-party organizations are involved in the transaction. Each verification step adds a small fee to the total cost. In addition, international conversion rates must be accounted for. World Bank reports have averaged these costs to be around 7.45 percent of each transaction processed.

Blockchain Remittance Fintech: Technology to Help Millions

Blockchain remittance companies are taking the industry to the next level by facilitating a frictionless experience for users. Traditionally, international money transfers can take days to complete due to the number of verifications that are required. Blockchain remittance companies provide instant money transfer services.

Remittance Firms: Abra

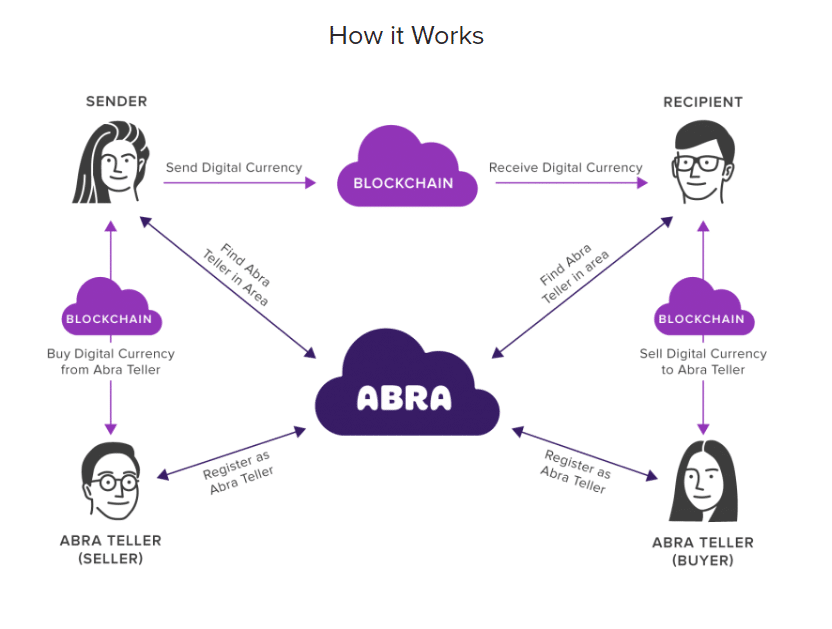

Africa relies heavily on remittance payments. Until recently, large financial firms, such as Western Union and MoneyGram, dominated the market. This changed when blockchain remittance companies began to spring up across the continent. Firms such as Abra are now changing the local markets.

The Abra platform allows users to transfer money for free across the globe. In addition to these cost savings, users are able to send transactions directly from their mobile devices. Abra offers a direct peer-to-peer money transfer technology that doesn’t require the use of any bank. And, the platform automatically deposits funds onto debit cards that it provides for users.

Abra is pioneering remittance FinTech with this all-inclusive approach. This non-reliance on the traditional banking system is important in developing nations because they often lack the means to implement the expensive infrastructure required to institute these organizations. By circumventing the current system, Abra users don’t have to worry about how to transfer money from blockchain to bank account.

Migrants are saving on fees and conversion rate costs by removing the middleman from the remittance system. These savings are too large to ignore, and now, industry leaders are researching this technology.

Blockchain Remittance on the Rise

For the first time ever, this year’s Global Money Transfer Summit (GMTS) will feature blockchain remittance FinTech. The GMTS is the largest international money transfer conference in the world. Every year, representatives from major financial Photo Credit: CoinCentral institutions are chosen to speak at this event.

This Article is Originally Posted on CoinCentral.com